School Bonds in 2020

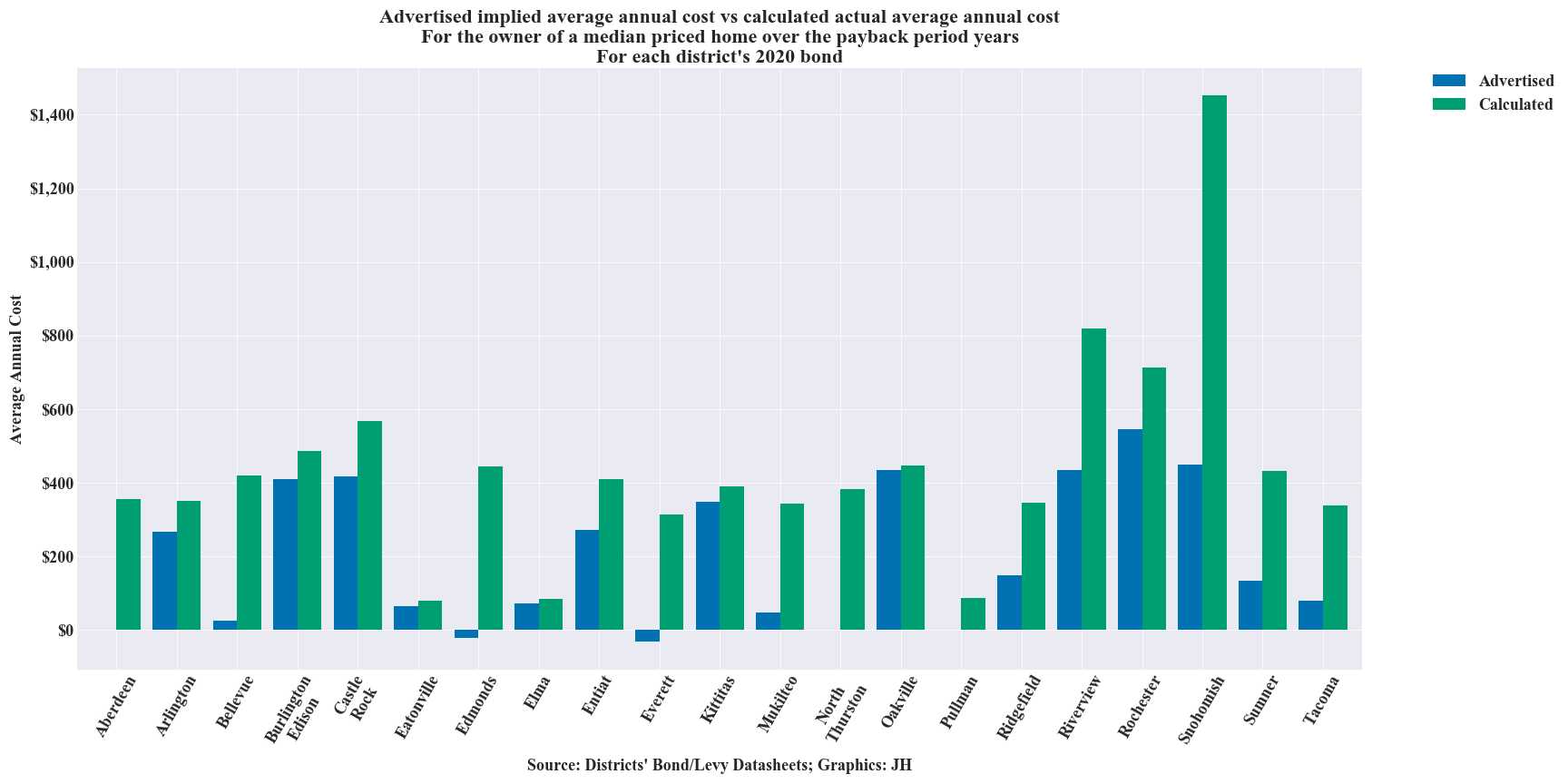

There were 21 school districts in WA that had a school bond on the ballot in 2020. This report focuses on the advertised cost and the analyzed actual cost to the local taxpayer for those bonds.

Contents

- Summary chart: Advertised costs vs calculated actual costs

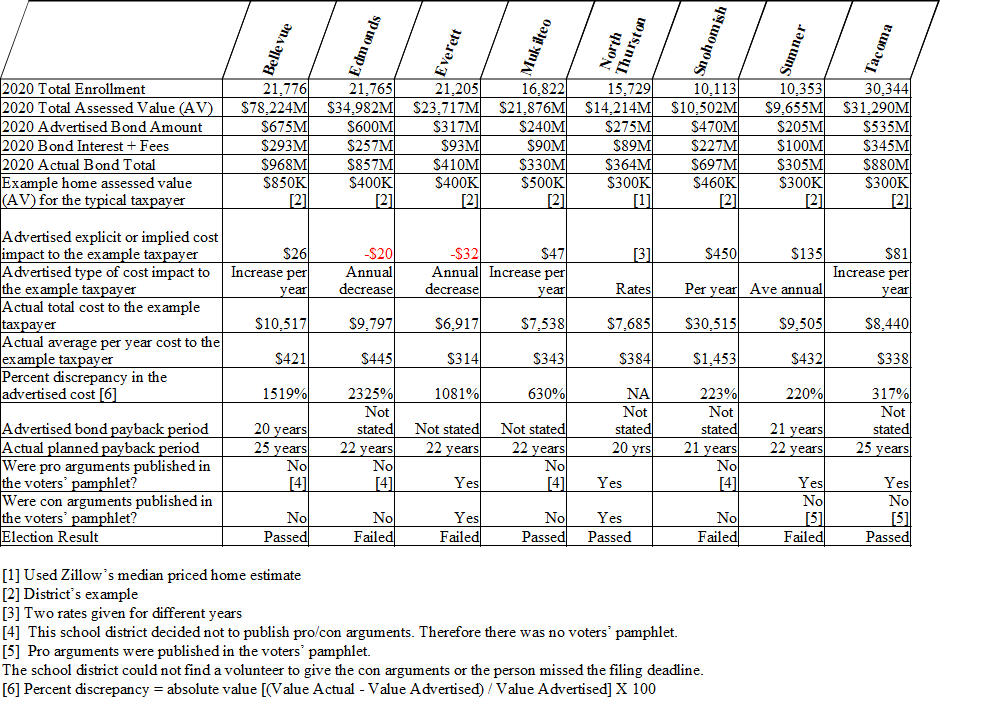

- Summary table: Large districts (More than 10,000 students)

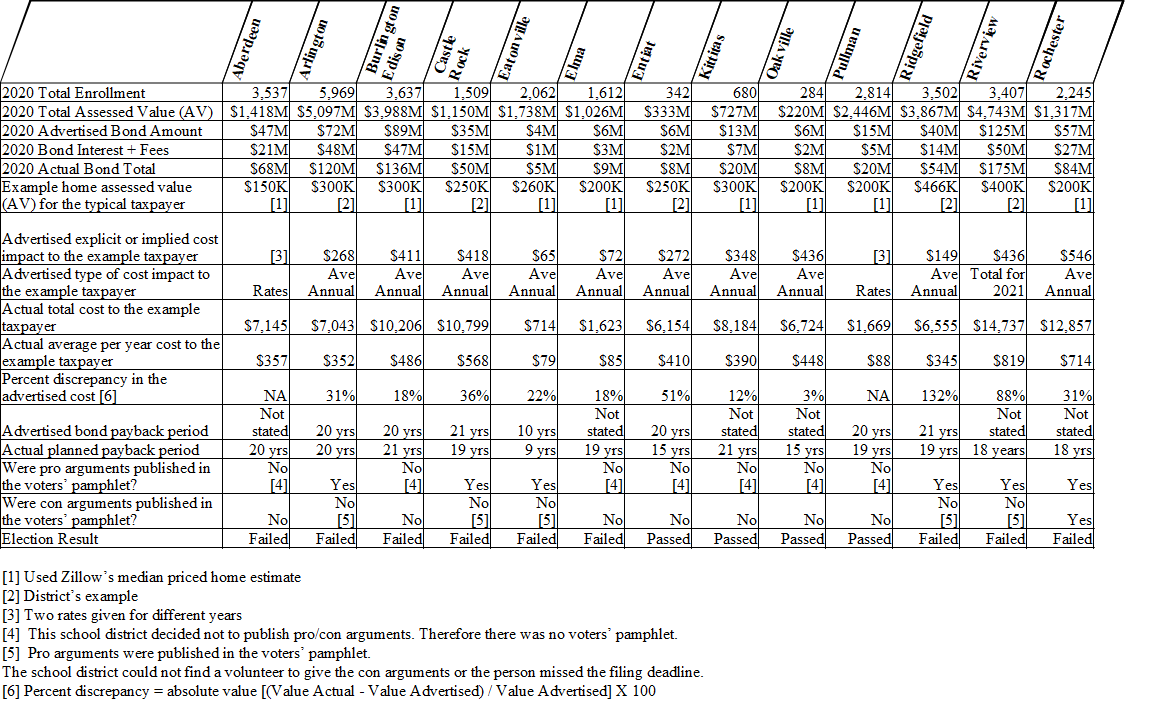

- Summary table: Small districts (Fewer than 10,000 students)

- Advertised cost vs calculated actual cost for each district

- Bond cost advertisement explained [1]

- Methodology

[1] For districts with 80+% discrepancy

Summary chart: Advertised costs vs calculated actual costs

Summary table: Large districts (More than 10,000 students)

Summary table: Small districts (Fewer than 10,000 students)

Advertised cost vs calculated actual cost for each district

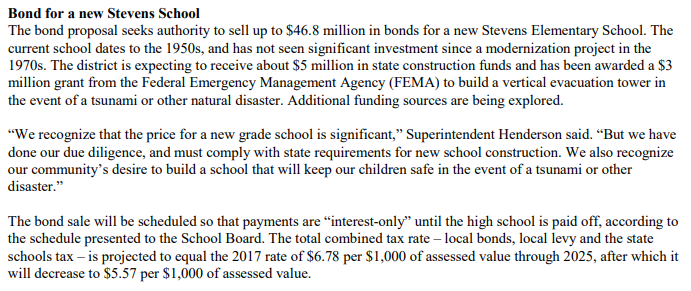

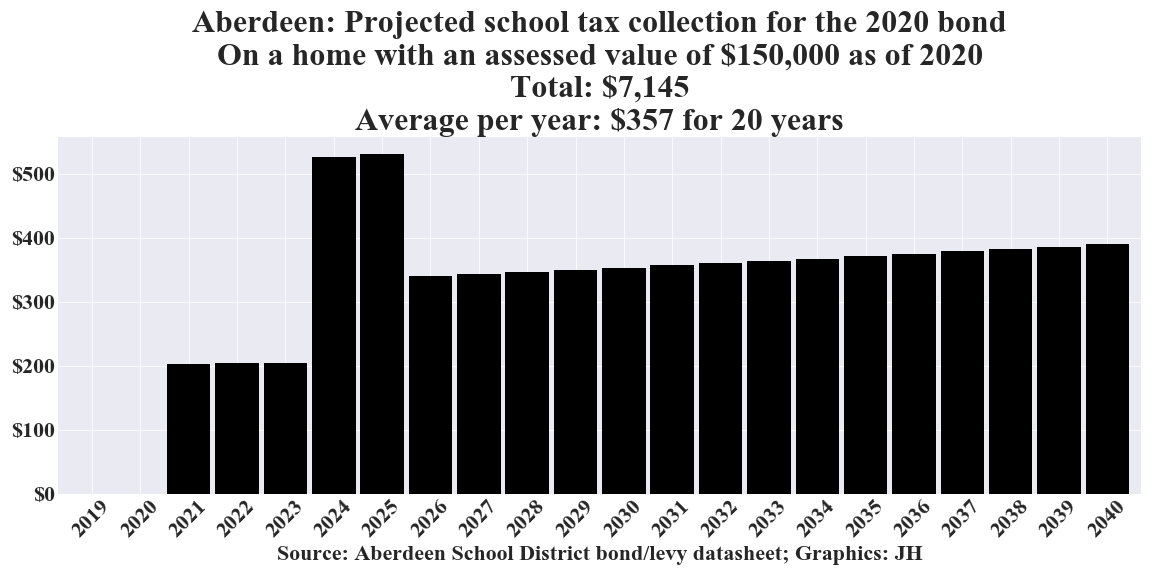

Aberdeen

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

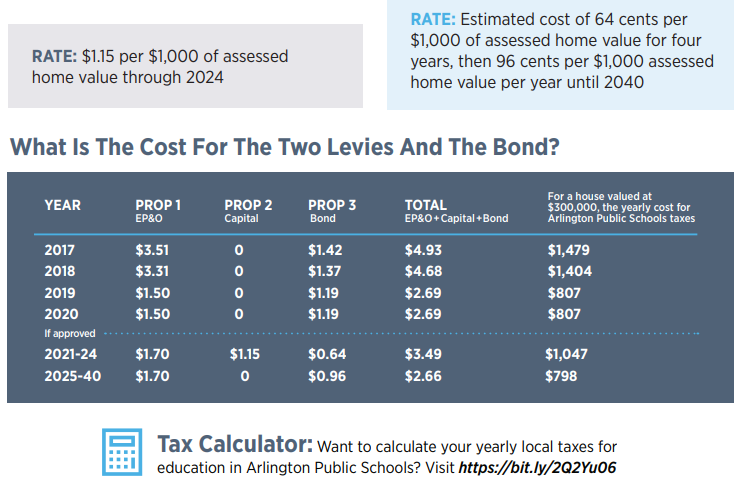

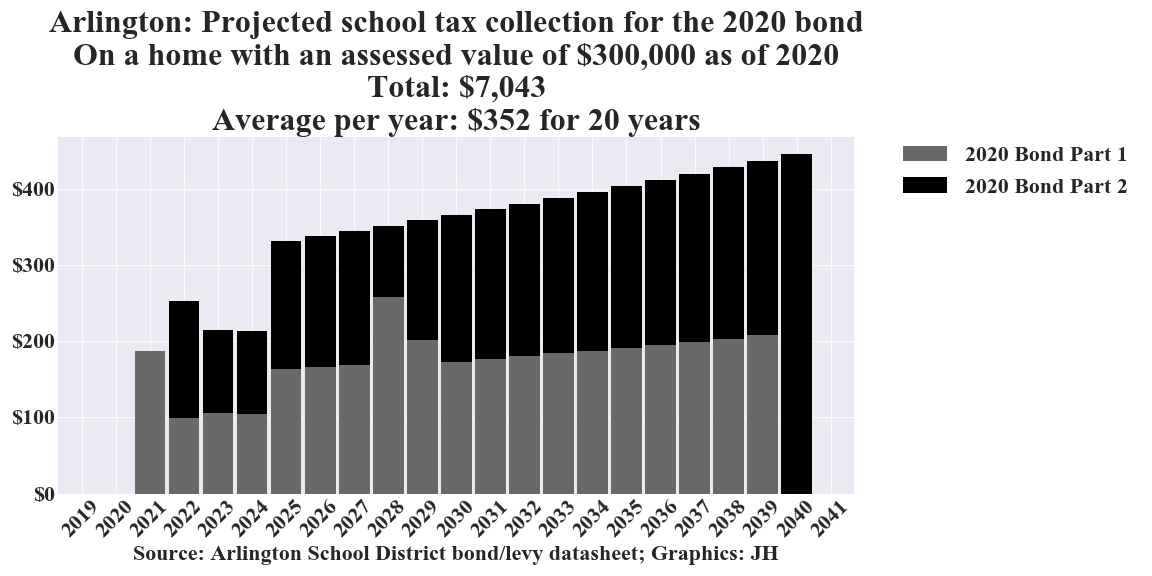

Arlington

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

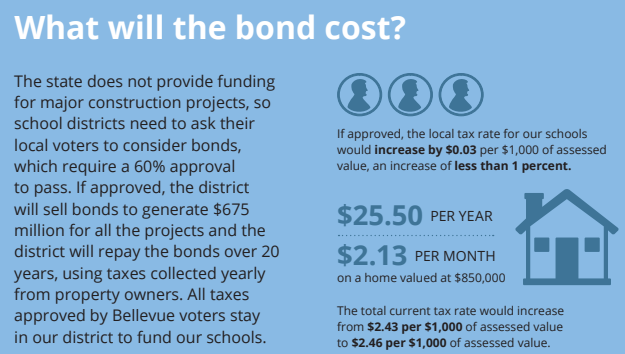

Bellevue

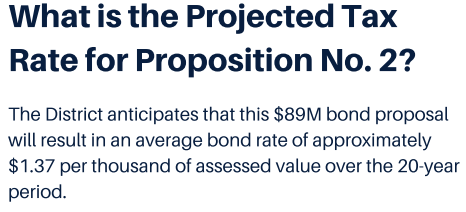

Bond cost to taxpayers as represented by the school district

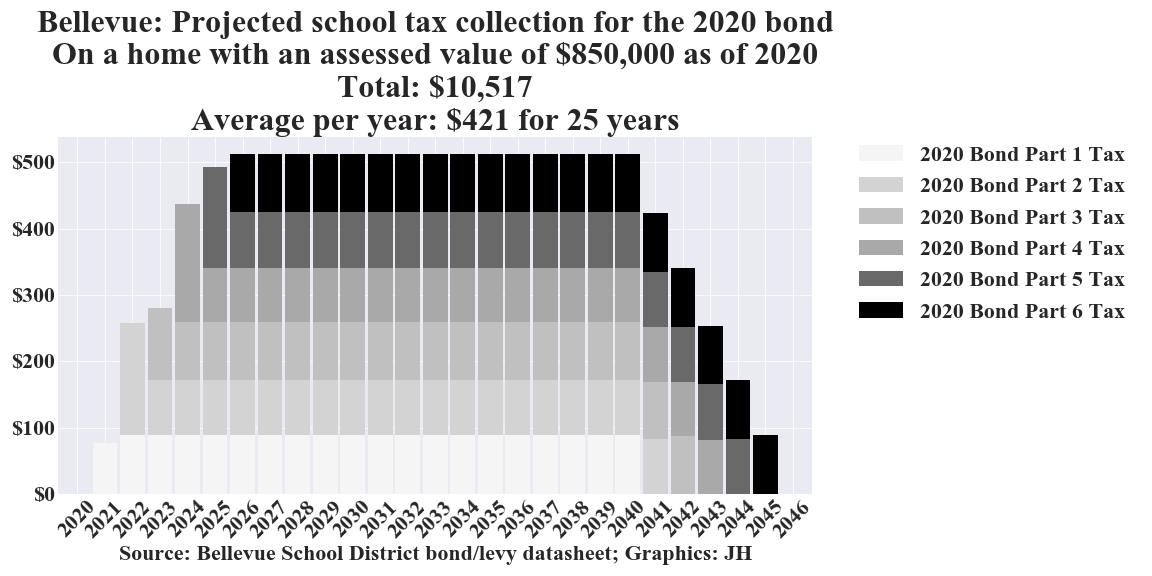

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

Burlington Edison

Bond cost to taxpayers as represented by the school district

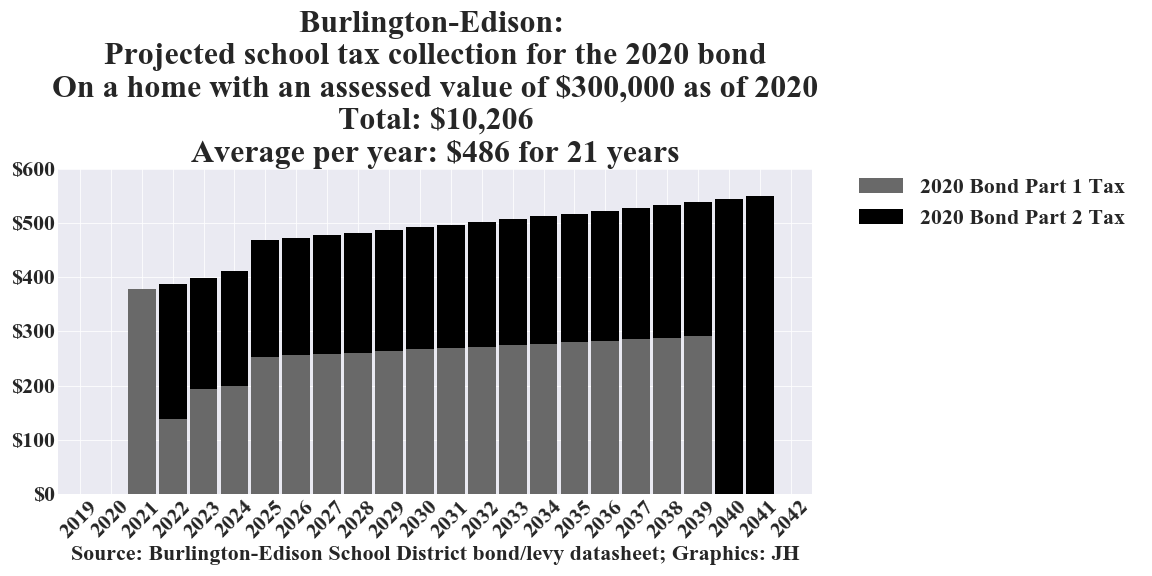

Bond cost to taxpayers as calculated by the authors

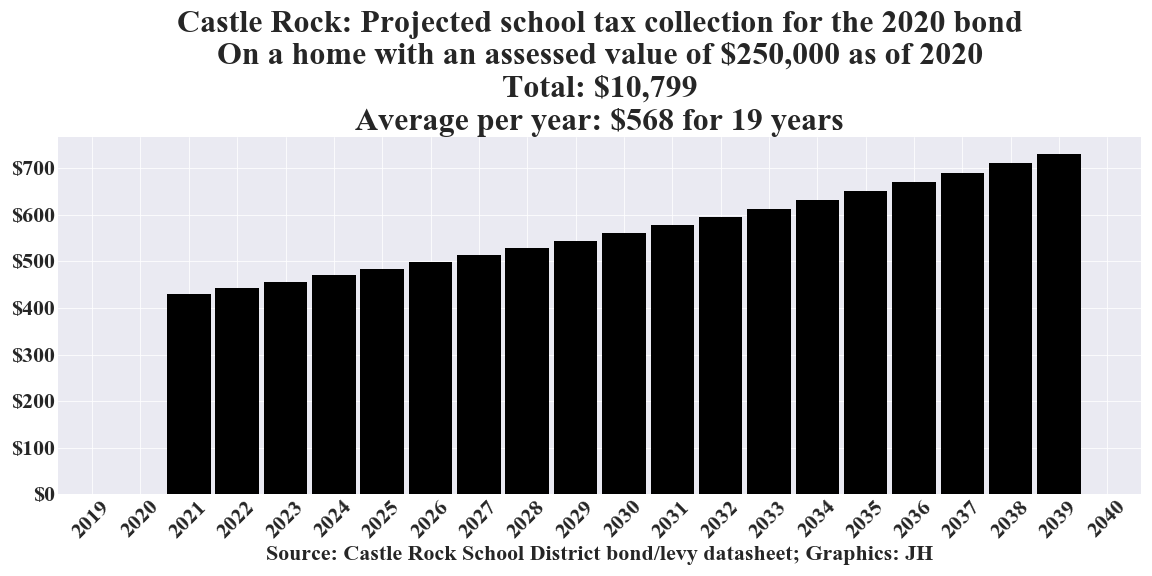

Castle Rock

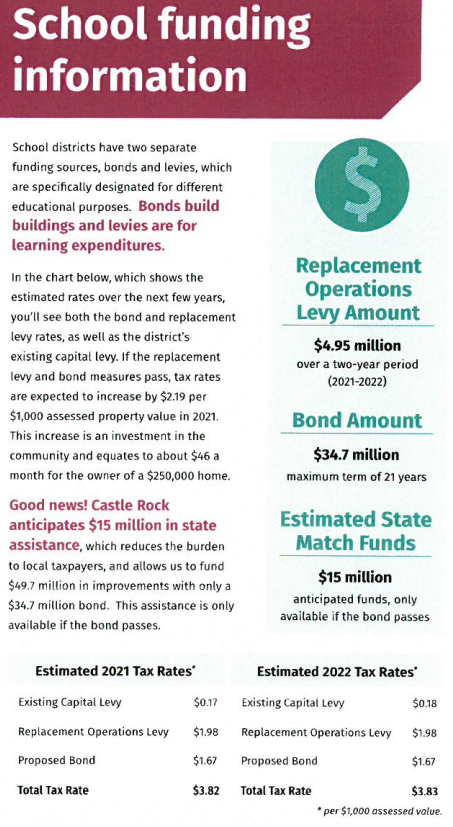

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

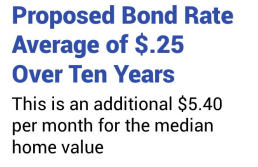

Eatonville

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

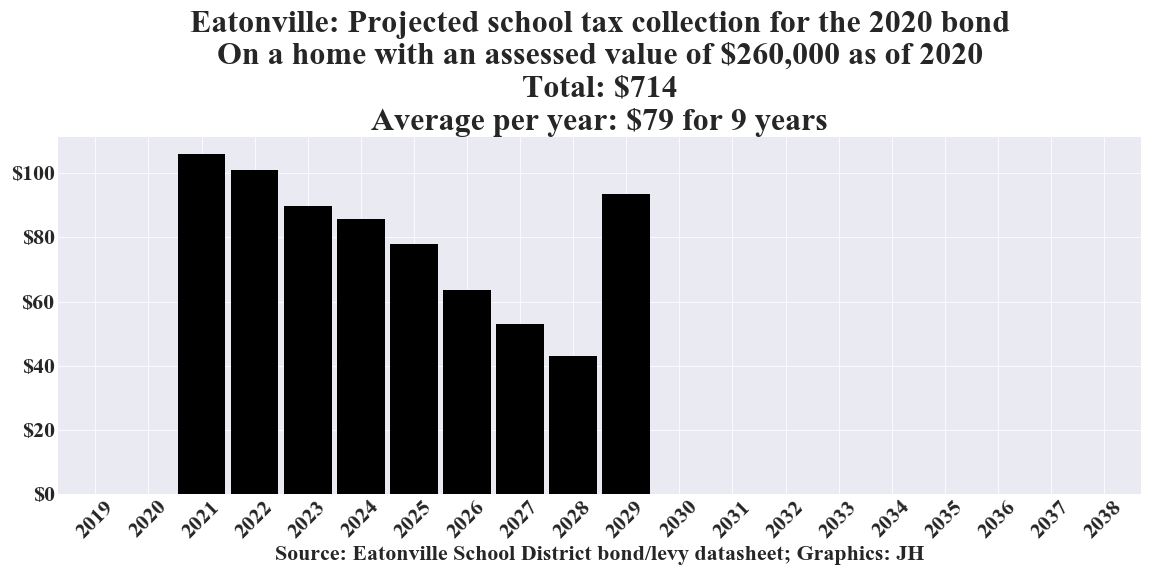

Edmonds

Bond cost to taxpayers as represented by the school district

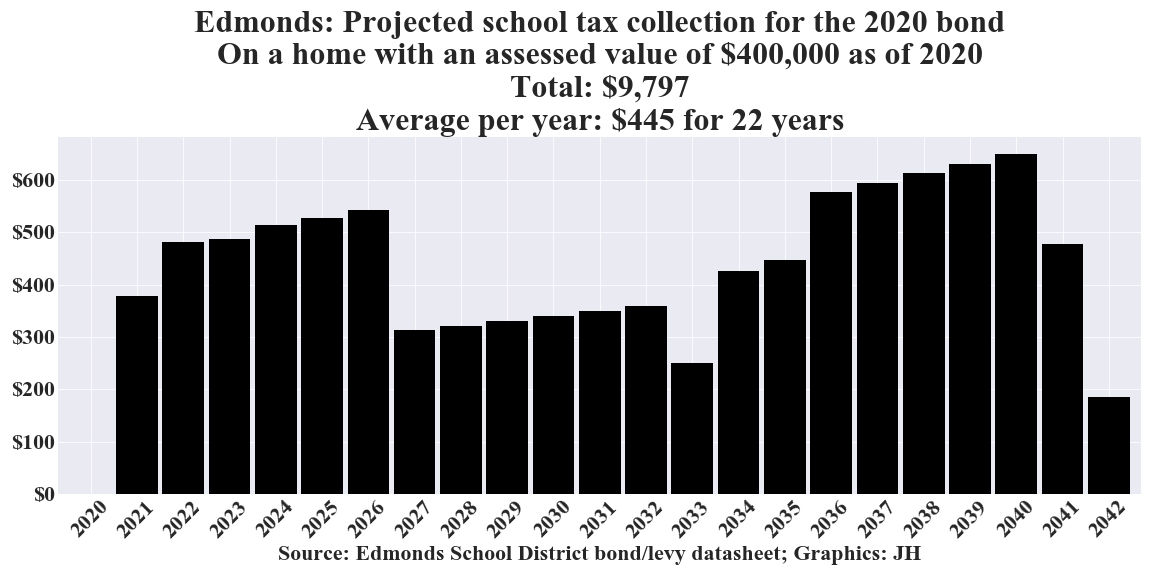

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

Elma

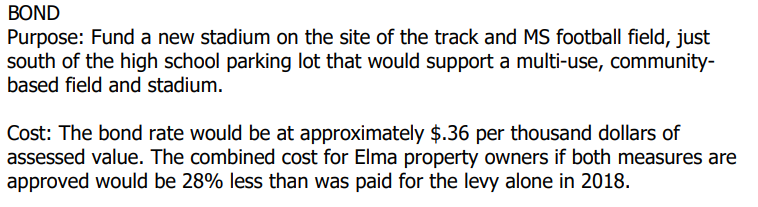

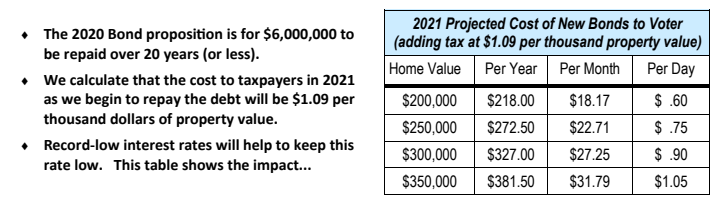

Bond cost to taxpayers as represented by the school district

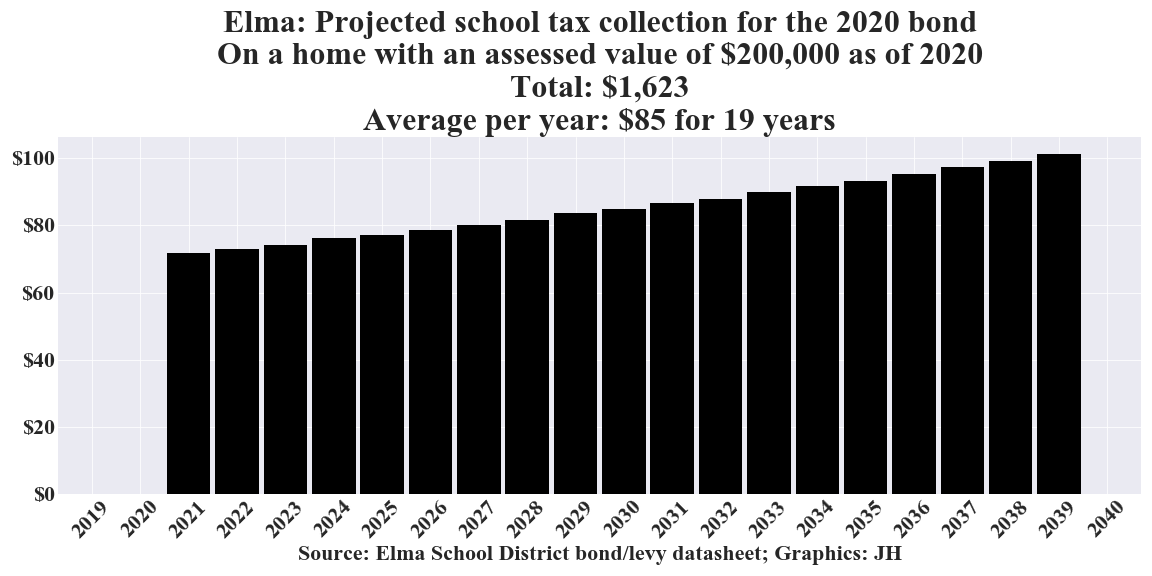

Bond cost to taxpayers as calculated by the authors

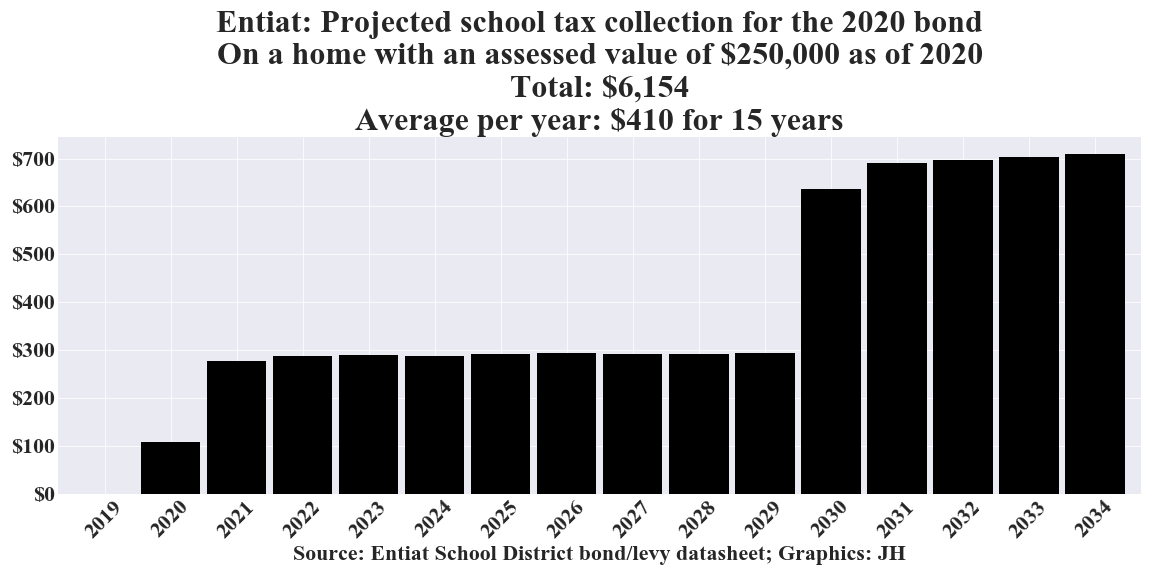

Entiat

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

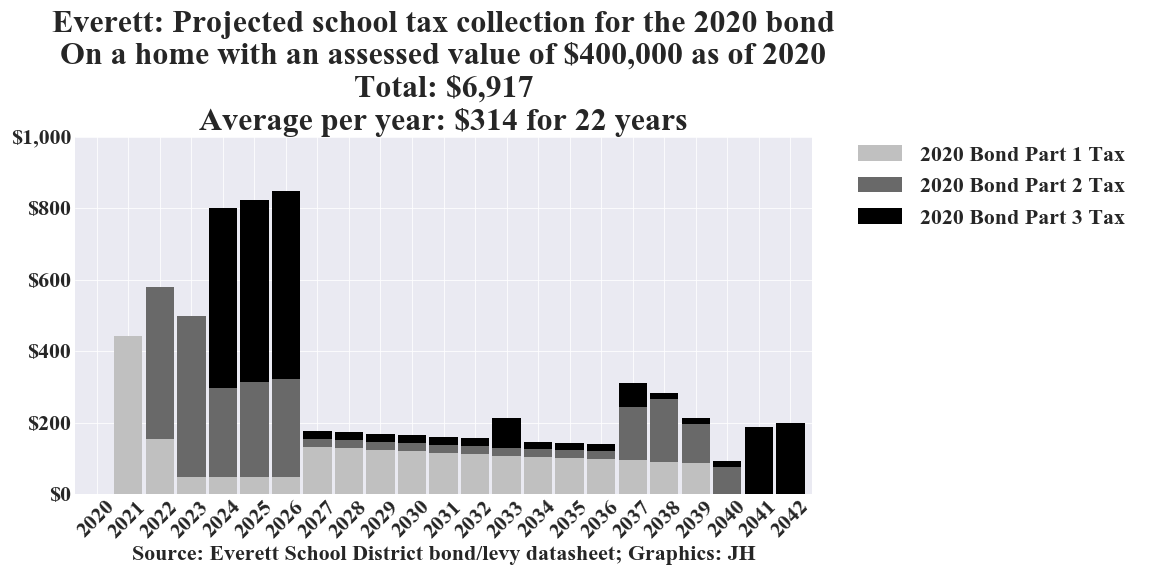

Everett

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

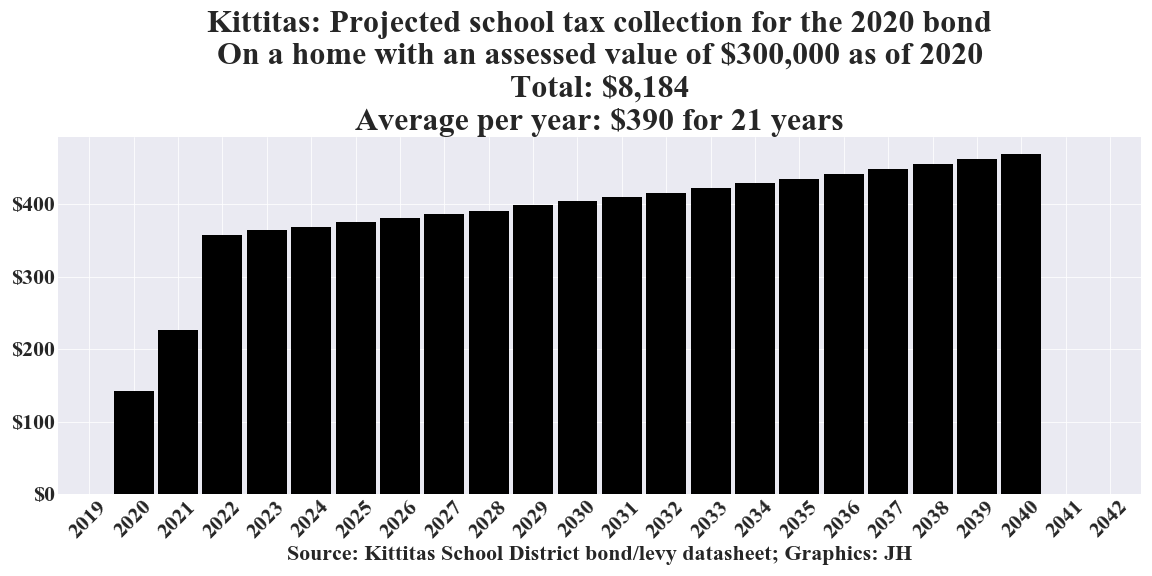

Kittitas

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

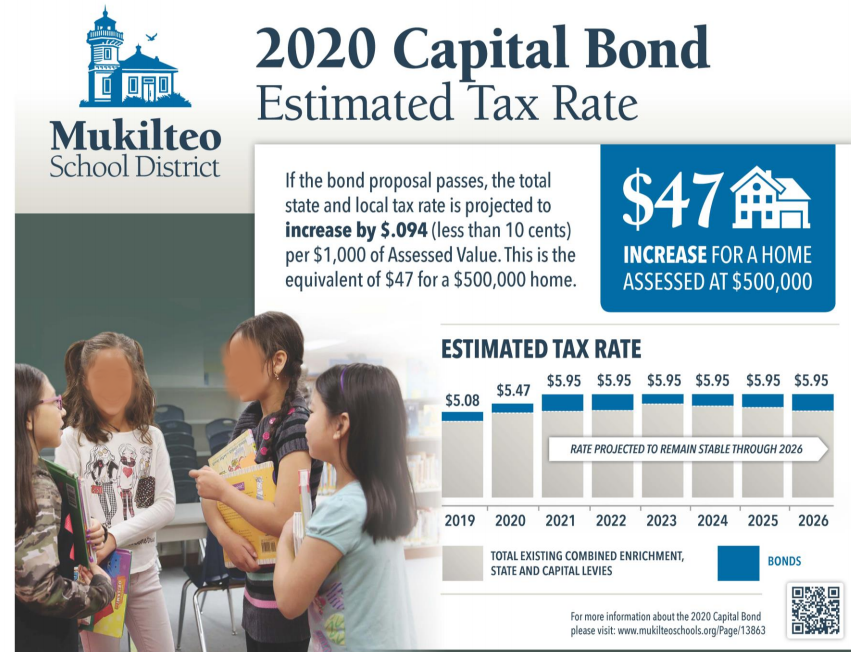

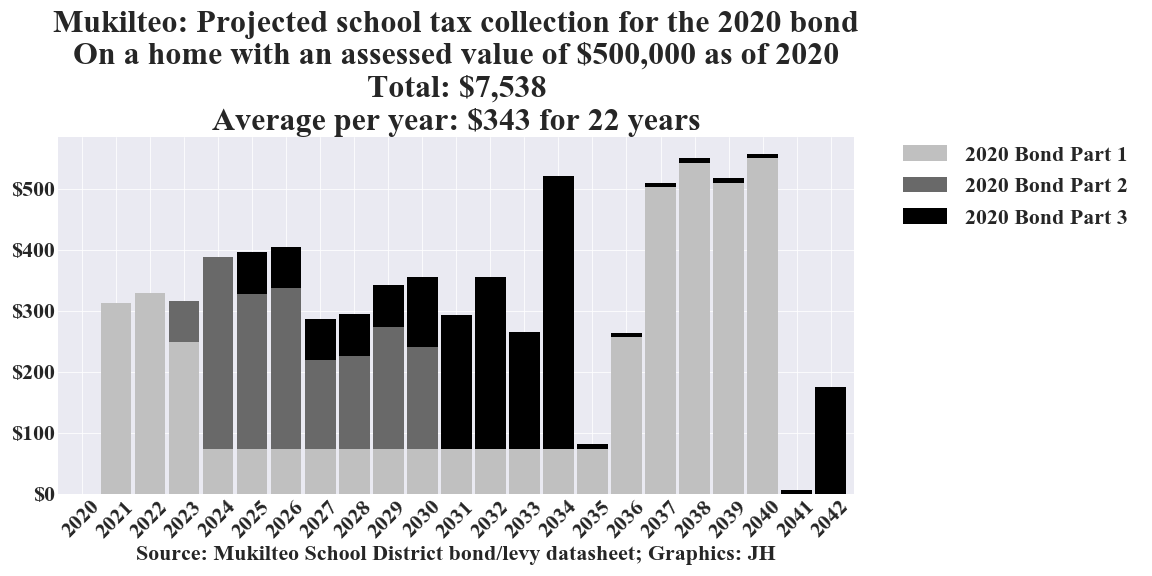

Mukilteo

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

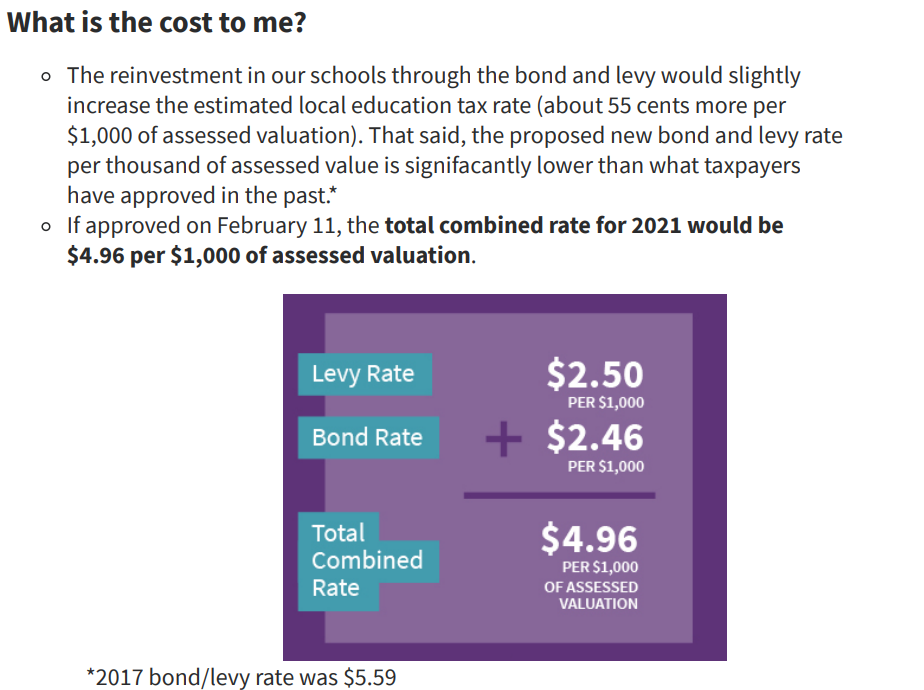

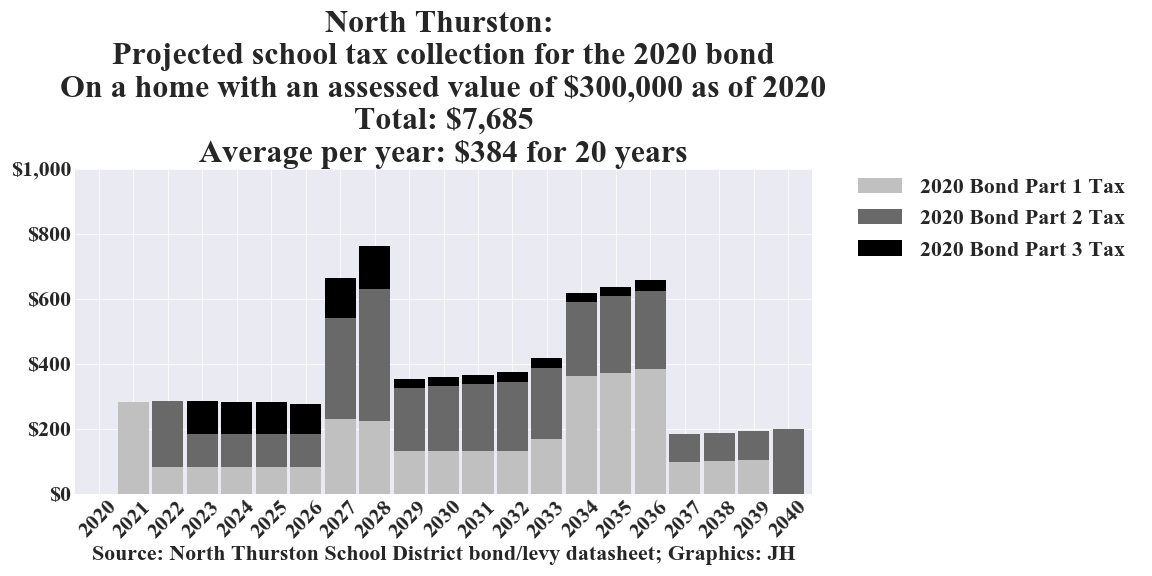

North Thurston

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

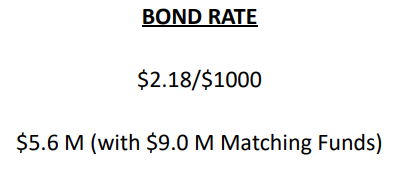

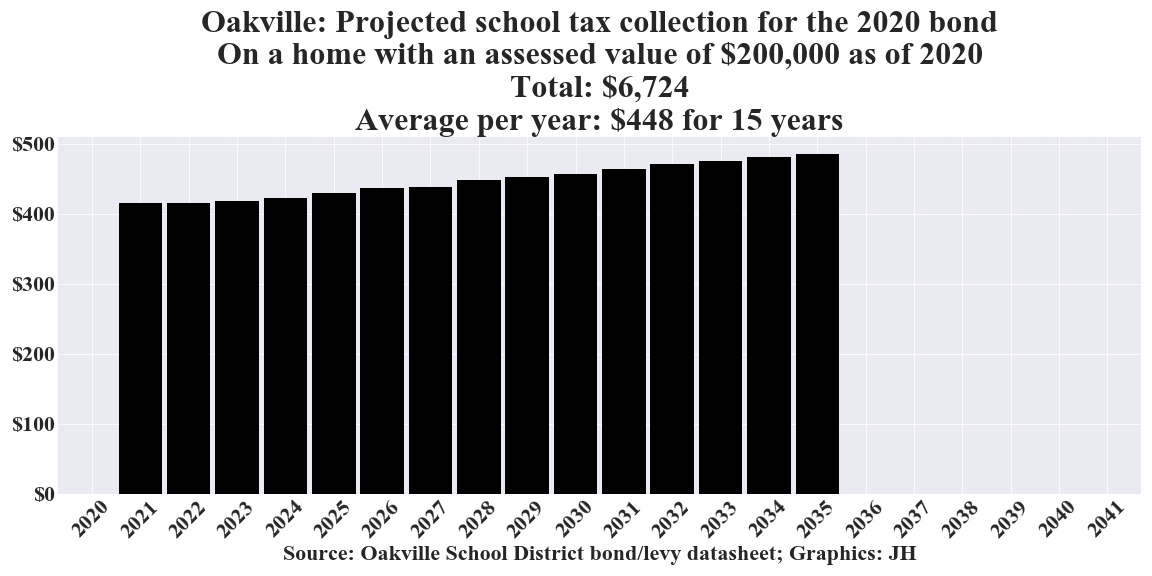

Oakville

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

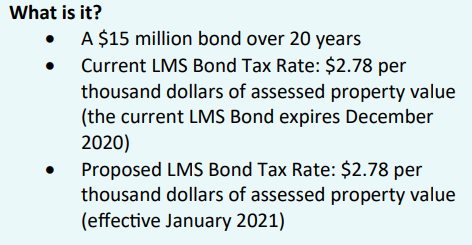

Pullman

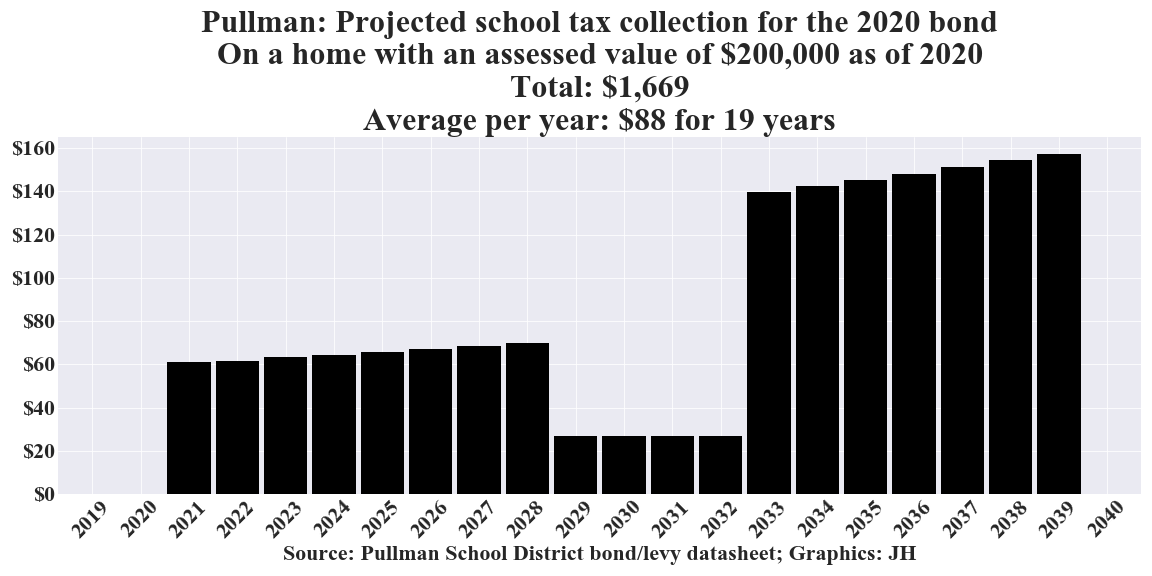

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

Ridgefield

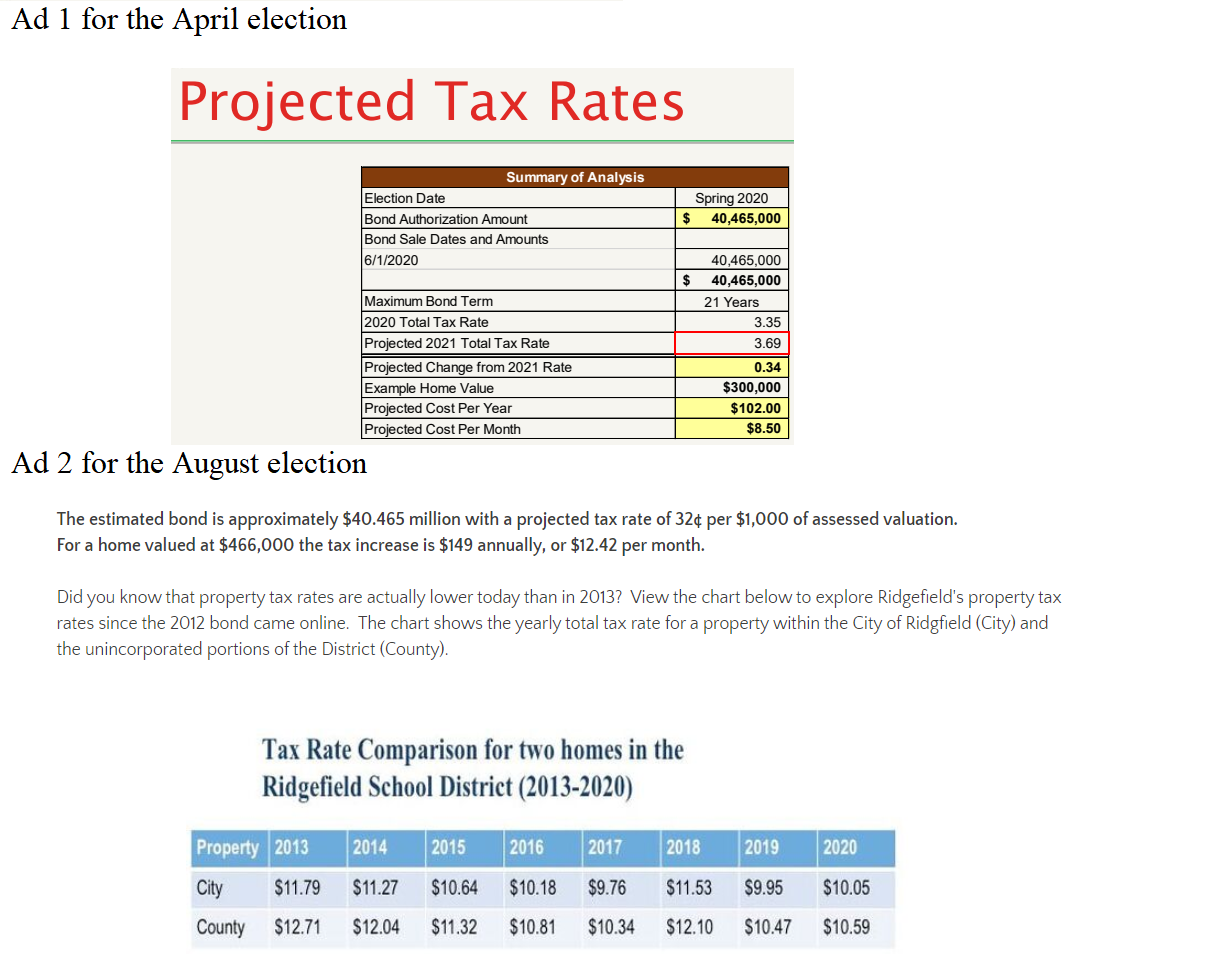

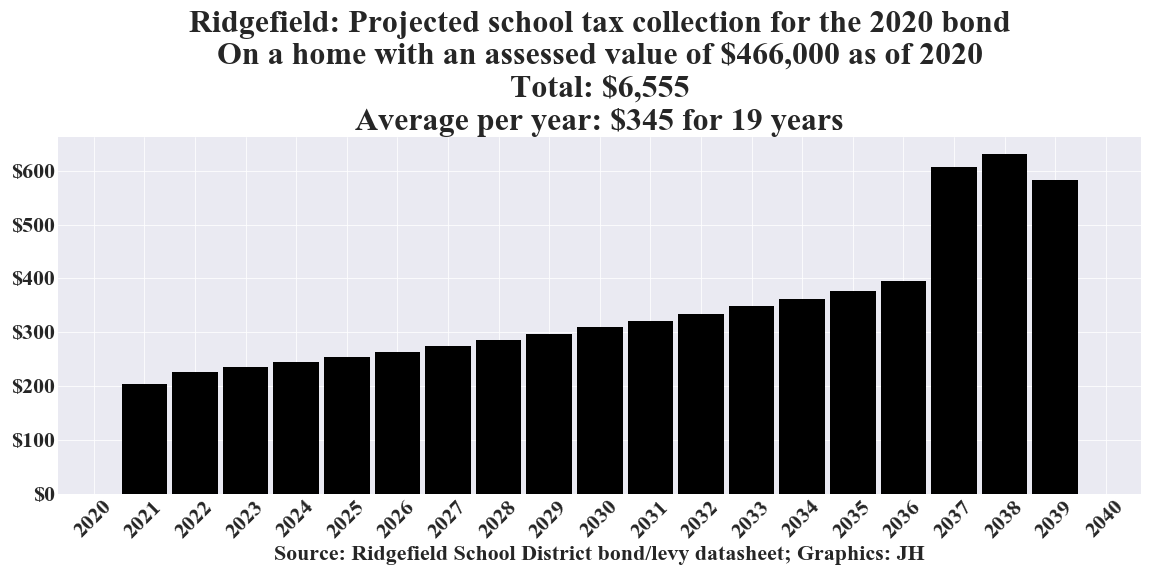

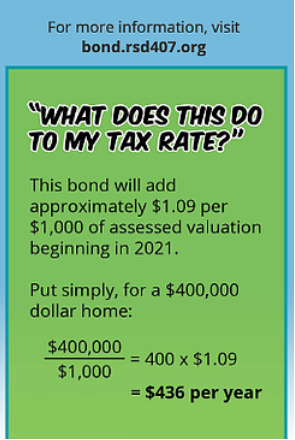

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

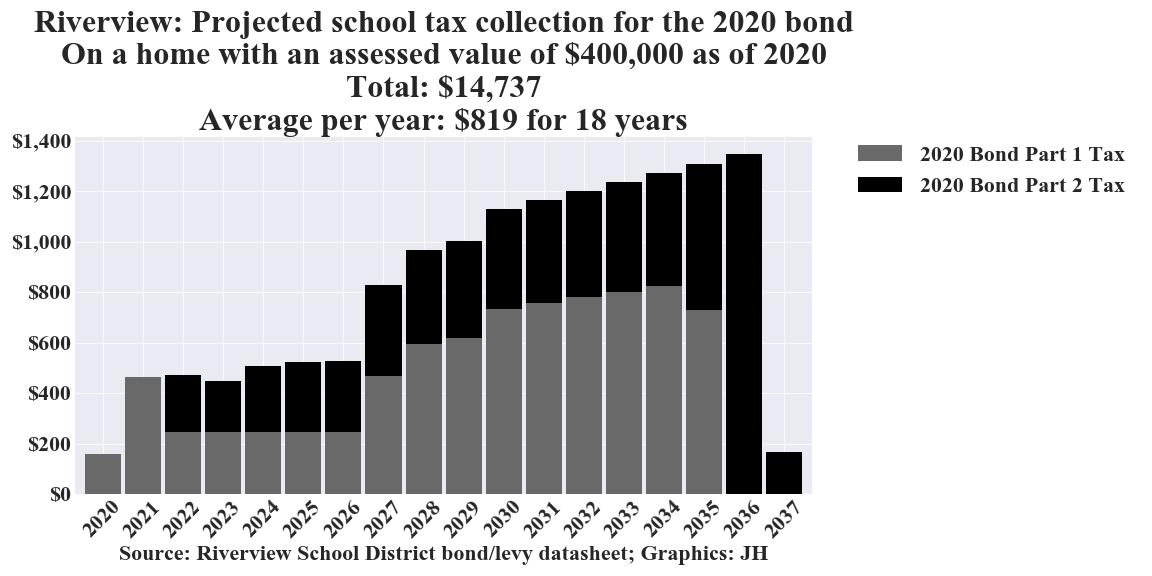

Riverview

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

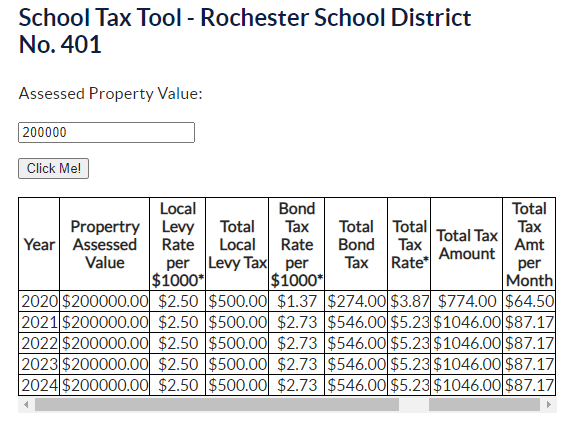

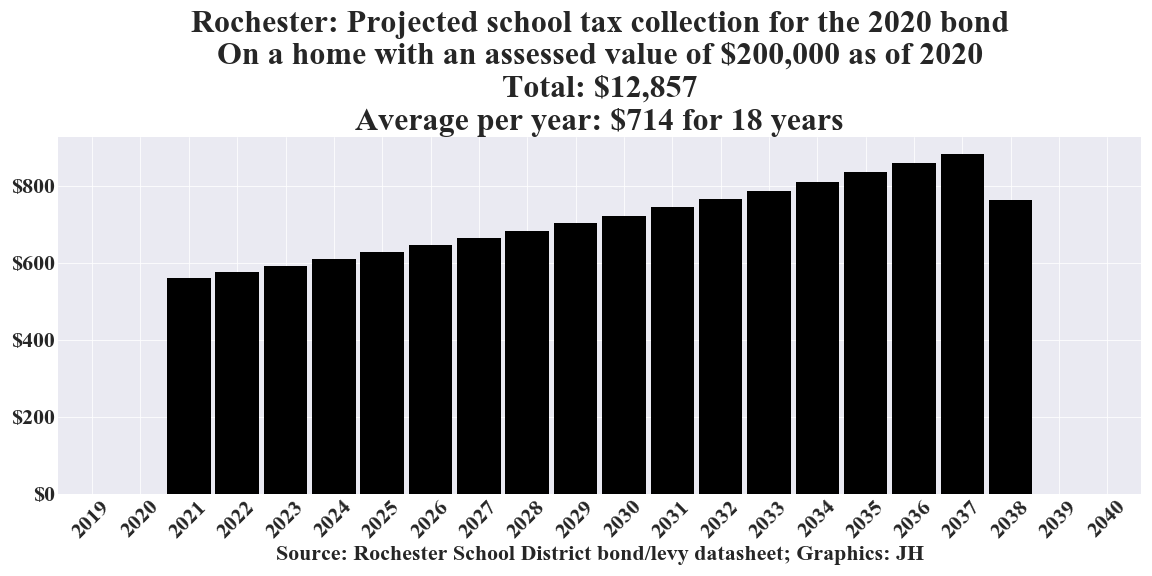

Rochester

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

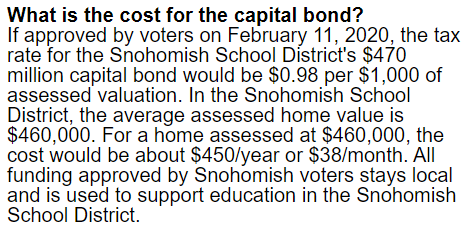

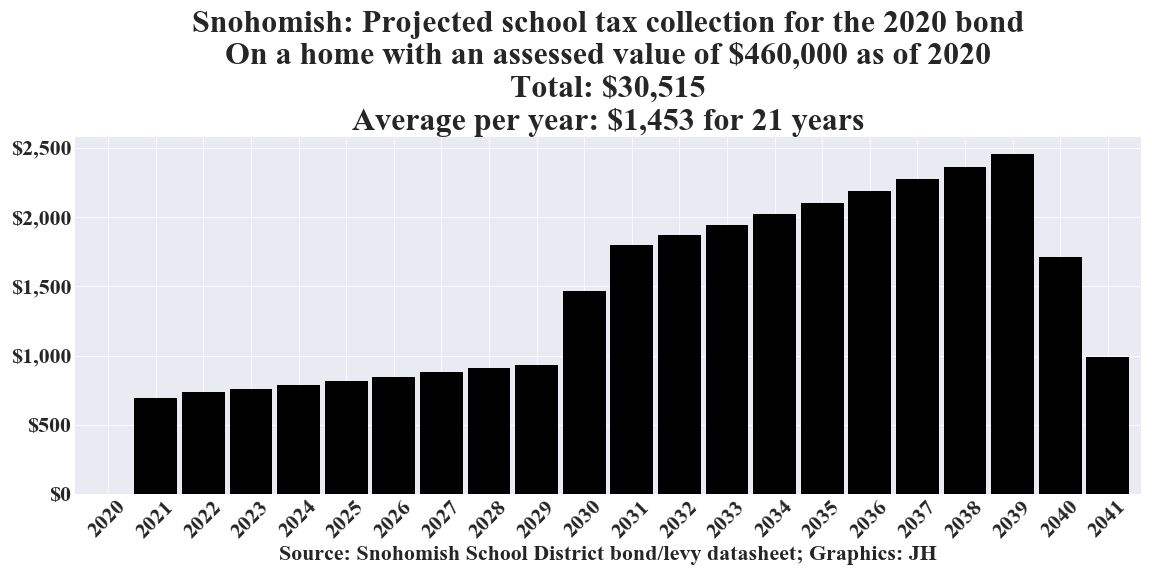

Snohomish

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

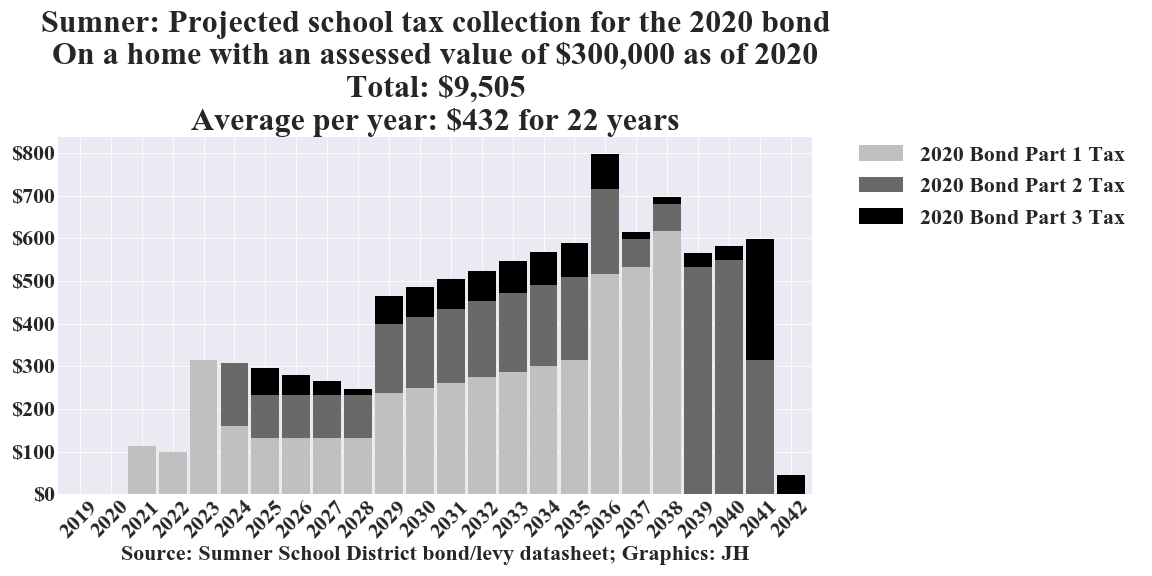

Sumner

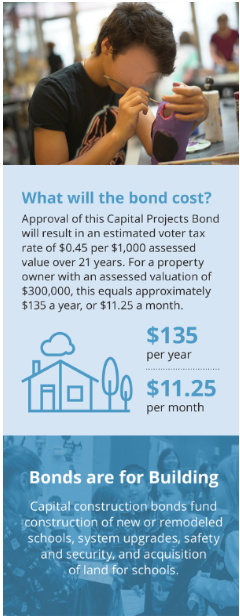

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

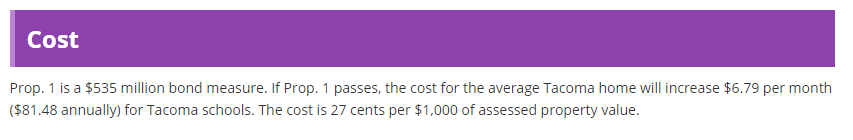

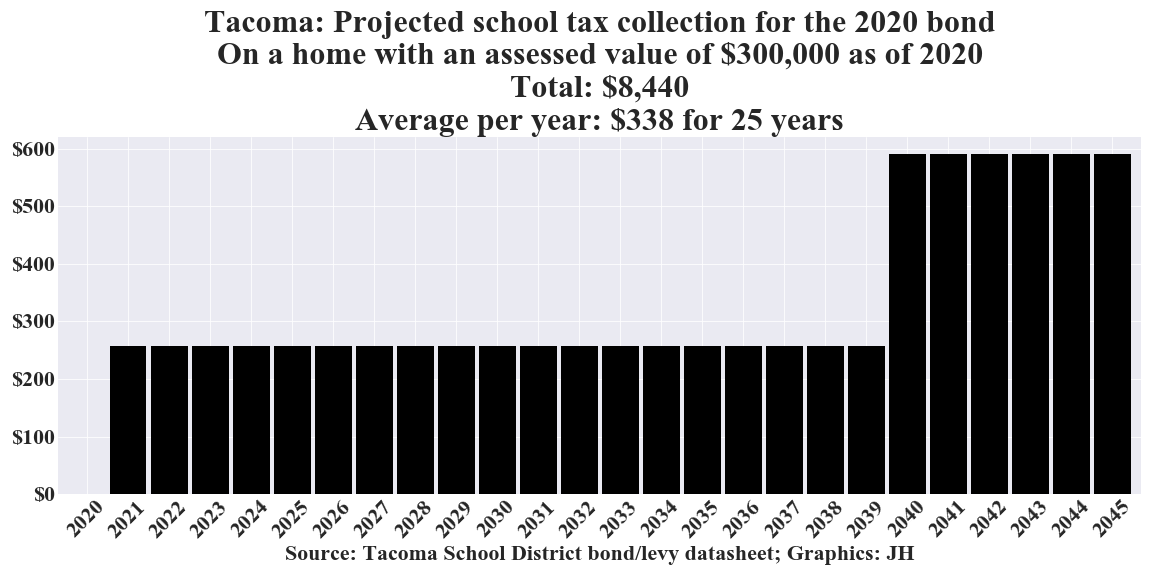

Tacoma

Bond cost to taxpayers as represented by the school district

Bond cost to taxpayers as calculated by the authors

Bond cost advertisement explained

Methodology

For this analysis, the annual assessed value (AV) growth rates (increases or decreases) for the example property owners’ properties were set to the same values as the Total AV Growth Rates that their respective districts used in their projections in their levy and bond datasheets.

New homes, apartments, and businesses that come on the market in the future at some point over the payback period of the bond are not taken into account. These would add to the tax base and potentially lower the bond payback obligation to the existing property owners.

Since, in this methodology and its assumptions, the existing properties’ AVs all track the Total AV, it doesn’t matter if all properties increase in AV by 10% or all decrease in AV by 10% (which could happen in a recession). The tax collection schedule shown in the charts would still apply for the example homeowner. The example homeowner’s proportion of obligation for the bond debt remains the same over the payback period. Tax rates, however, would change. If all properties increase in AV by 10%, the tax rate for this bond would decrease by approximately 10%. If all properties decrease in AV by 10%, the tax rate for this bond would increase by approximately 10%.